25+ Mortgage prequalification

First know that the buying process is different for an investment property compared to a primary home. The current average 30-year fixed mortgage rate is 589 according to Freddie.

Same Day Mortgage Pre Approval Online With Competitive Mortgage Rates Preapproved Mortgage Business Ideas For Beginners Mortgage

425 APR 2000.

. Baby boomers who tend to have the most experience with home buying as theyre most likely to have purchased sold and downsized know terms best. Its a great way to know if you satisfy minimum mortgage requirements. 30-year fixed mortgage rates.

Mortgage-pre-qualifying and pre-approval may seem like similar procedures. You can adjust your monthly mortgage payment by changing the loan terms. Are based on a fixed-rate period of 5 years that could change in interest rate each subsequent year for the next 25 years a down payment.

And like some other top lenders Marcus doesnt. Simple Online Application Compare mortgage options and apply in minutes with our streamlined quote and. Conventional and Jumbo Loans Find the right mortgage for your needs with fixed and adjustable-rate options for both conventional and jumbo loans.

Minimum personal credit score of 600 for FHA VA and USDA loans. The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global. A mortgage in itself is not a debt it is the lenders security for a debt.

Prequalification with soft credit check. A mortgage rate lock freezes your interest rate until loan closing. Lender obtained a Tri-Merged Residential Credit Report.

When available a Live Chat agent will book an appointment for you at your nearest branch. If youre comfortable with your rate and the monthly payment fits your budget consider locking it in. Flexible Down Payment Options Pay as little as 5 down for conventional loans or 3 down for eligible applicants.

Home Lending Customer Service 1-800-422-2442. Savings account or other collateral. Help Contact Questions and Applications 1-888-KEY-0018.

Prequalification helps you see how much you might be able to borrow. AmeriSaves requirements are standard. Actual rate buydown per point varies by loan.

In a few simple steps learn how much of a mortgage you may qualify for with the HSBC Mortgage Prequalification Calculator. Learn more about US. Mortgage points are fees paid to the lender for a reduced interest rate.

Prequalification helps you see how much you might be able to borrow. Mortgage loan terms can vary but most borrowers choose either a fixed-rate 15-year or 30-year mortgage. Although Gen Z is the furthest from the home buying process their millennial counterparts were 4 less familiar with.

2 points 4 APR 4000. Clients under 25 Seniors Foreign Workers New to Canada Banking Bundle Cross-Border Banking Tools and Resources Compare Bank Accounts Bank Account Selector Bank Account Calculators. Borrowers can access APRs between 699 and 1999 with a 025 discount for autopay enrollees.

Based on the information provided Buyer can pre-qualify for a loan amount of. For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. Demographically older people understand different home buying terms better than others.

Find out everything you need to know right here. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. Maximum debt-to-income ratio DTI of 45 to qualify for a conventional loan.

If you default you risk losing your home in a foreclosure. Minimum personal credit score of 620 to qualify for conventional mortgages. Banks current mortgage rates in Minnesota and see how residing in different states can impact your loan.

Clients using a TDDTTY device. Prequalification can be done online or over the phone and usually takes one to three days. Learn more about US.

95483 Sample APRs and points are for illustrative and educational purposes only and are not an actual rate quote prequalification or commitment to lend. By comparison a 0. Mortgage rates are determined by the amount borrowed and personal finances like credit history loan terms and down payment combined with greater economic factors like the federal reserve rate the prime rate the overall economy and the housing market.

Not sure of the difference between mortgage prequalification and preapproval. Banks current mortgage rates in Wisconsin and see how residing in different states can impact your loan. Use our free mortgage calculator to estimate your monthly mortgage payments.

Todays national mortgage rate trends. August 25 2022. Mortgage interest rates are always changing and there are a lot of factors that.

With a residential mortgage your house is the collateral. When you apply for prequalification lenders will do a. How are mortgage rates determined.

Which limits payments to 15 of income for a 25-year period if borrowers cant afford their payments. Click More details for tips on how to save money on your mortgage in the long run. 25 per month.

See if a lender will prequalify you and do this with at least three lenders. Some people may even use these terms interchangeably which make it confusing for buyers. Which you can check using lenders prequalification tools on.

Amortizations greater than 25 years and exceptions to HSBCs standard lending. AmeriSaves eligibility criteria are similar to what most mortgage providers require. Before you invest in property make sure you meet the following qualifications.

Note your personal mortgage rate will differ from what you see on Chases. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. Account Interest Rate APY Minimum Deposit to Open Minimum Balance to Obtain APY 91 Day 015.

Lender completed a verbal discussion with Buyer including a discussion of income assets and debts. Are based on a fixed-rate period of 5 years that could change in interest rate each subsequent year for the next 25 years a down payment. Get up to 3000 cash back when you switch to a CIBC Mortgage.

Account for interest rates and break down payments in an easy to use amortization schedule. The calculators results page will return a loan option best fit for your needs including the length projected. Our mortgage calculator can help you determine what mortgage you can afford by taking simple information about your finances and prospective home to predict your monthly payments including your principal and interest rate.

Best Mortgage Lenders. How can a mortgage calculator help me. Investment properties require a much higher financial stability level than primary homes especially if you plan to rent the home to tenants.

What It Means To Be Pre Qualified Vs Pre Approved Rwm Home Loans

1

Mortgage Loan Approval Process Explained The 6 Steps To Closing The Hbi Blog Mortgage Loans Mortgage Approval Mortgage Loan Originator

:max_bytes(150000):strip_icc()/mortgage_contract-5c4254734cedfd0001ce1a99.jpg)

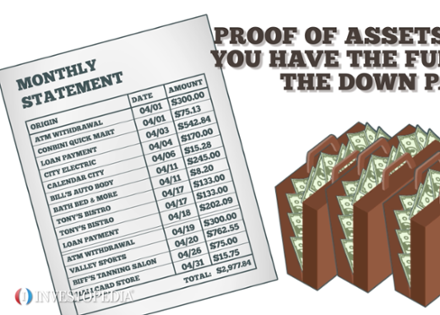

5 Things You Need To Be Pre Approved For A Mortgage

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

How To Get A Mortgage Pre Approval In Texas

How To Get Mortgage Pre Approval In Texas Texas United Mortgage

When And Why Should I Get Pre Approved For A Mortgage Preapproved Mortgage Mortgage Refinance Mortgage

How And Why To Get Pre Approved For A Mortgage Preapproved Mortgage Real Estate Marketing Plan Real Estate Tips

3

Beth Bloom Sr Loan Officer Lauch Pad Mentor Big Valley Mortgage Linkedin

Here Is A Comprehensive Mortgage Pre Approval Checklist Of The Items You Need To Submit To Your Mortgage Len In 2022 Good Credit Mortgage Approval Preapproved Mortgage

1

5 Things You Need To Be Pre Approved For A Mortgage

3

The Difference In Being Prequalified Vs Preapproved For A Mortgage Home Buying Preapproval Home Loans

Mortgage Gift Letter Template Elegant Sample Gift Letters Pertaining To Bequest Letter Template In 2022 Letter Gifts Printable Letter Templates Letter Template Word